Alternatives to Checkout.com

1. Adyen Uplift

+Pros

- Comprehensive Integration Approach distinguishes Adyen Uplift through simultaneous optimization of conversion rates, fraud prevention, and processing costs within a single platform.

- Proven Enterprise Performance demonstrates consistent results across 60+ enterprise implementations, with documented outcomes including 10% higher conversion rates (NordSecurity) and 2% conversion increases with cost reductions (On).

- Unique Data Advantages through access to over $1 trillion in processed payment data and 1+ billion consumer transaction profiles provide AI training capabilities that independent vendors cannot replicate.

- Operational Efficiency Gains through 86% reduction in manual fraud rules provide substantial workforce benefits beyond conversion improvements.

-Cons

- Platform Dependency represents the primary constraint, requiring existing Adyen payment processing relationships or complete payment infrastructure migration.

- Enterprise-Only Focus creates barriers for SMB retailers who may achieve reduced benefits compared to enterprise results.

- Limited Specialization in conversational AI or customer interaction capabilities means organizations seeking assisted shopping experiences require supplementary solutions.

- Implementation Complexity extends beyond typical payment optimization projects due to AI model training and comprehensive integration requirements.

One highlighted feature and why it's amazing

Forms the platform's core capability, utilizing machine learning models trained on over $1 trillion in payment data to optimize transaction success rates across multiple payment processors and geographic regions.

Another highlighted feature of why it’s amazing

Achieves over 90% accuracy in identifying returning customers across merchant networks, enabling personalized payment experiences without requiring customer login or registration.

2. Bolt

+Pros

- Universal Shopper Network of 80+ million consumers provides genuine competitive differentiation through cross-merchant shopper recognition.

- Unified checkout infrastructure integrates fraud detection, payment processing, and shopper identity management into a single platform.

- Customer evidence demonstrates measurable impact with 3.2-4% revenue improvements through AI-powered personalization.

-Cons

- Enterprise deployments require 4-6 months for full optimization compared to simpler payment processing solutions.

- The proprietary nature of Bolt's protocols and one-click system architecture creates vendor relationship considerations, potentially increasing switching costs by 40% compared to more open alternatives.

One highlighted feature and why it's amazing

Bolt's Checkout 2.0 system analyzes real-time signals including device type, purchase history, and behavioral patterns to create self-learning shopper profiles that adapt checkout flows dynamically.

Another highlighted feature of why it’s amazing

The platform's 80+ million consumer network enables instant recognition of 50% of shoppers across merchant sites, even first-time visitors, pre-populating shipping and payment details for faster checkout completion.

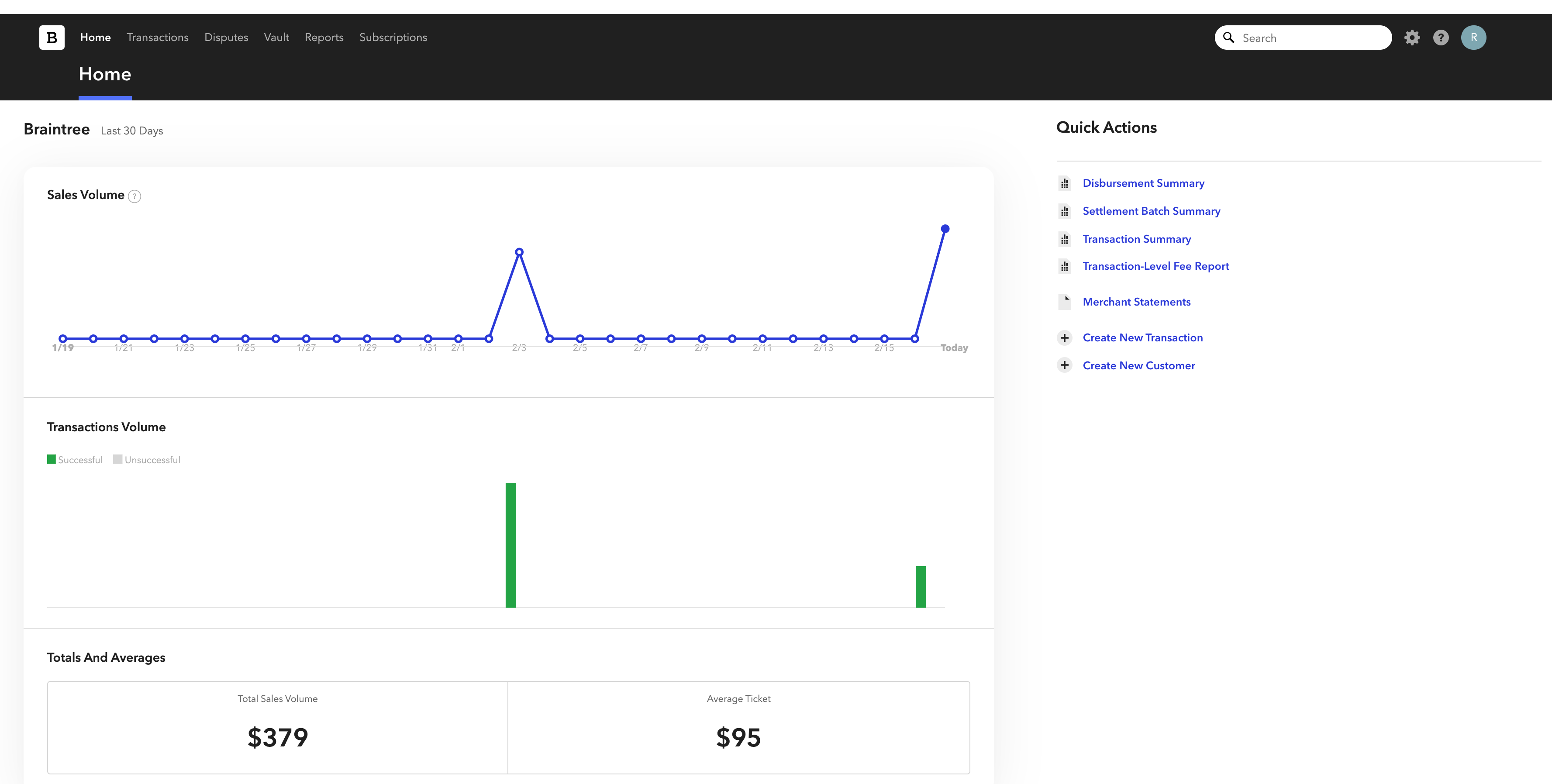

3. PayPal Braintree

+Pros

- Native PayPal and Venmo integration providing competitive advantages unavailable from alternatives like Stripe.

- Fraud Protection Advanced leverages machine learning trained on billions of PayPal transactions to achieve 95% fraud detection accuracy while reducing false positives by 14%.

- Smart Retries capability delivers 57% recovery rates for failed payments through intelligent timing optimization.

- Enterprise support and consultative approach differentiate Braintree from more transactional competitors.

-Cons

- Implementation complexity requiring 120-160 developer hours for custom integrations and 4-6 week minimum timelines.

- SMB accessibility represents a significant weakness, with 32% of SMBs reporting implementation failures due to insufficient transaction data volume for AI training.

- GDPR compliance challenges affect 15% of EU implementations due to conflicts between transaction data usage and privacy requirements.

One highlighted feature and why it's amazing

Analyzes over 200 data points per transaction using machine learning trained on billions of PayPal transactions. Achieves 95% accuracy while reducing false positives by 14% and maintaining sub-2-second checkout speeds.

Another highlighted feature of why it’s amazing

Uses machine learning to predict optimal retry timing for failed transactions based on historical success patterns. Achieves 57% recovery rates for declined payments by analyzing transaction failure reasons, issuer response patterns, and timing data to schedule retry attempts when success probability is highest.

Other Alternatives

Recurly

Stripe Optimized Checkout Suite

Worldpay

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

204+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.