Adobe Express for Enterprise: Complete Buyer's Guide

Democratizing creative capabilities with enterprise-grade governance

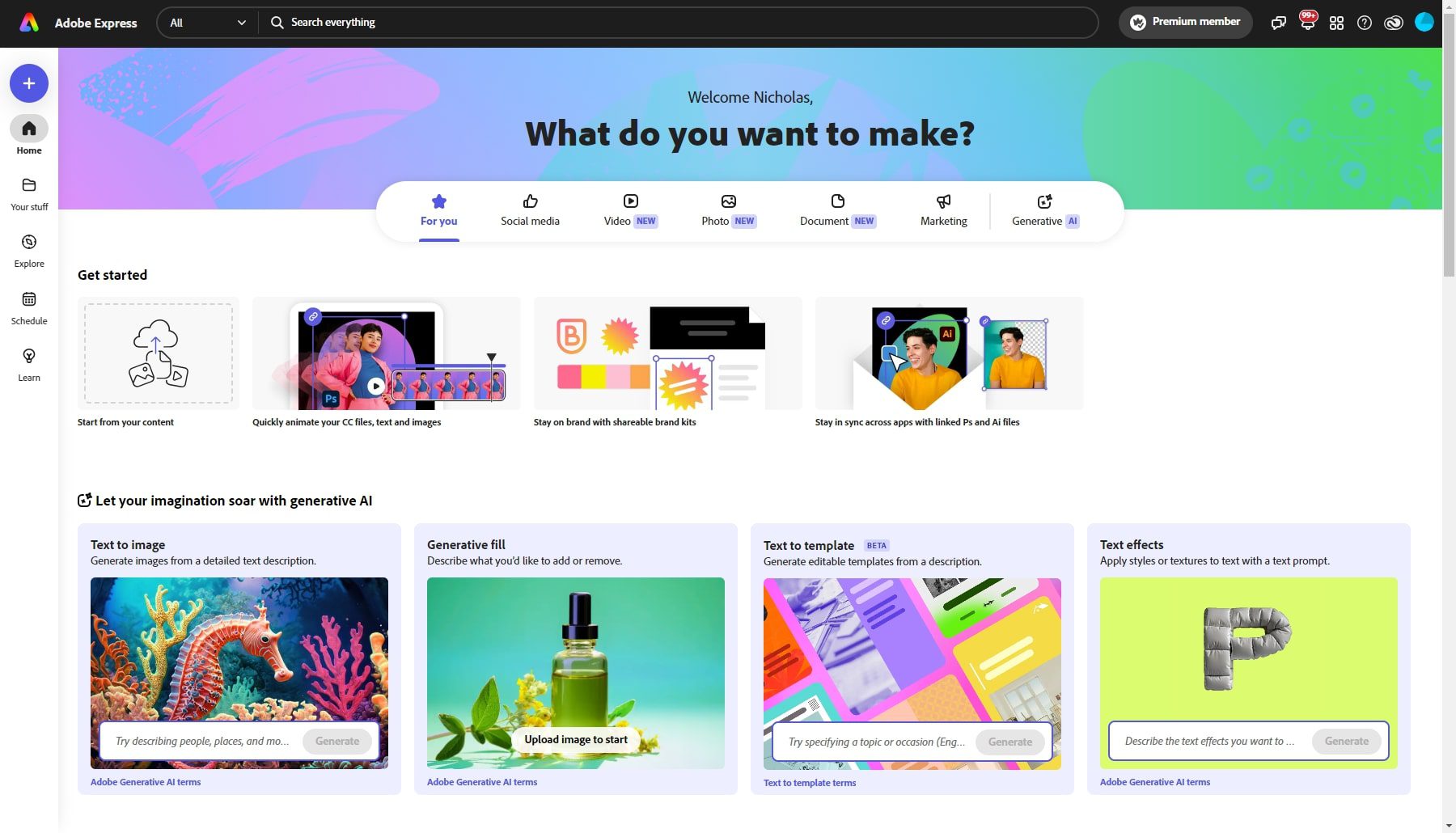

Adobe Express for Enterprise is a premium AI-powered design platform that democratizes creative capabilities while maintaining enterprise-grade brand governance and Creative Cloud ecosystem integration.

Market Position & Maturity

Market Standing

Adobe Express for Enterprise operates from a position of established market leadership within the broader Creative Cloud ecosystem, leveraging Adobe's $19.4 billion annual revenue and 26 million Creative Cloud subscribers to provide enterprise-grade stability and long-term viability [134].

Company Maturity

Adobe demonstrates 40+ years of creative software leadership and established enterprise relationships across Fortune 500 organizations [131][135].

Growth Trajectory

Continued investment in AI capabilities, with Firefly integration launched in October 2024 representing significant R&D commitment [129][135].

Industry Recognition

Leadership positions in Gartner Magic Quadrants for creative software and established partnerships with major enterprise technology providers [129][130][132][135].

Strategic Partnerships

Deep integrations with Microsoft Office 365, Google Workspace, and major marketing automation platforms [126][131].

Longevity Assessment

Strong long-term viability through diversified revenue streams, established enterprise relationships, and continued innovation investment [68][72].

Proof of Capabilities

Customer Evidence

IBM/Red Hat's comprehensive deployment enabled 400 marketers to create compliant assets, achieving 10x production cycle reduction [130]. Dentsu's campaign acceleration achieved 70% faster time-to-market [132][135].

Quantified Outcomes

Owen Jones reduced versioning errors by 40% through permission-based editing restrictions [135]. Red Hat achieved 200+ hours monthly savings in marketing asset creation [130].

Case Study Analysis

IBM/Red Hat's deployment demonstrates Adobe Express's ability to democratize design capabilities at enterprise scale without compromising quality standards [130].

Market Validation

Enterprise customer retention and expansion within existing accounts, though specific retention rates require verification through independent sources.

Competitive Wins

Wins against alternatives like Canva Enterprise and Visme in scenarios where ecosystem integration and brand governance requirements favor Adobe's comprehensive approach [126][131][134][135].

Reference Customers

Enterprise customers include IBM/Red Hat, Dentsu, and Prudential, demonstrating validation across technology, agency, and financial services sectors [129][130][132][135].

AI Technology

Firefly generative AI integrated across automated layout generation, intelligent content localization, and brand-consistent template adaptation [129][132][135].

Architecture

Adobe's proprietary Firefly models trained for commercial use with IP indemnification for generated content, Content Credentials metadata for provenance tracking, and native Creative Cloud connectivity [135].

Primary Competitors

Canva Enterprise, Visme, Designs.ai [9][12][20][21][75].

Competitive Advantages

Adobe's ecosystem integration and established enterprise infrastructure, deeper Creative Cloud integration, real-time asset sharing, Firefly AI providing IP indemnification, and comprehensive Content Credentials metadata [126][134][135].

Market Positioning

Adobe's strategy to leverage existing enterprise relationships and Creative Cloud investments rather than compete primarily on cost.

Win/Loss Scenarios

Win scenarios favor organizations with existing Adobe infrastructure, complex brand governance requirements, and high-volume content production needs. Loss scenarios typically involve cost-sensitive buyers or organizations without Adobe investments.

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of AI Brochure Creators for AI Design for AI Design professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

136+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.