Amazon Advertising: Complete Buyer's Guide

Retail media powerhouse leveraging the world's largest e-commerce ecosystem

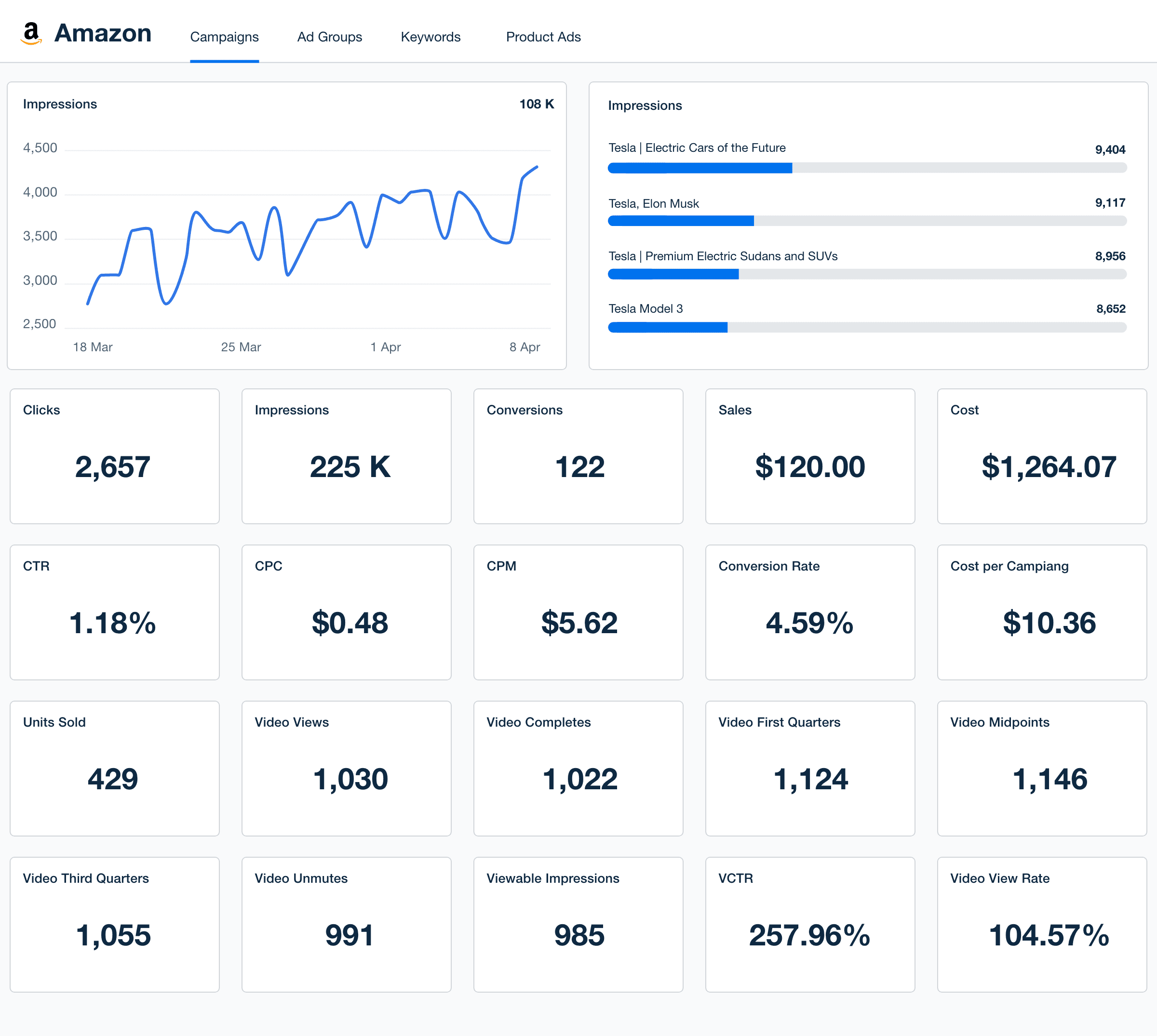

Amazon Advertising represents the retail media powerhouse leveraging the world's largest e-commerce ecosystem to deliver AI-powered advertising solutions with unmatched purchase attribution capabilities. Through its closed-loop integration of Amazon.com, Twitch, and Fire TV data, the platform enables advertisers to optimize campaigns based on actual purchase behavior rather than proxy metrics[44][52].

Market Position & Maturity

Market Standing

Amazon Advertising occupies a dominant position in retail media while maintaining specialized rather than universal digital advertising capabilities. Forrester's research positions Amazon DSP favorably for "retail media activation," specifically noting its access to "high-yielding inventory and verifiable revenue impact"[58].

Company Maturity

The platform's market maturity reflects Amazon's broader ecosystem strength, with established enterprise relationships and proven operational scale managing billions of daily impressions[30][31].

Growth Trajectory

The platform's investment in AI capabilities, including generative features and natural language processing, demonstrates continued innovation commitment rather than maintenance-mode operation.

Industry Recognition

Industry recognition includes consistent analyst acknowledgment of Amazon's unique data advantages and attribution capabilities. The platform's ability to provide "verifiable revenue impact" through actual purchase data represents a competitive moat that traditional advertising platforms cannot replicate[58].

Strategic Partnerships

Strategic partnerships with major brands demonstrate enterprise adoption patterns, with documented success stories from Volkswagen, EcoFlow, and numerous DTC brands achieving measurable business transformation[48][55][56].

Longevity Assessment

The platform's longevity assessment appears strong given Amazon's market position and strategic focus on advertising revenue growth, though organizations should consider platform dependencies when evaluating long-term vendor relationships[51].

Proof of Capabilities

Customer Evidence

Kazi's implementation achieved 350% sales growth within 12 months, transforming from struggling performance to market success through strategic Sponsored Products and Display campaign utilization[48].

Quantified Outcomes

Quantified performance metrics consistently demonstrate business impact: customers achieve 4x ROAS through strategic campaign optimization[48], while Performance+ delivers 51% lower acquisition costs compared to manual management[44].

Case Study Analysis

Volkswagen's Fire TV campaign generated 33 million impressions with 14.7% brand lift according to Lucid study findings, showcasing Amazon's streaming advertising effectiveness beyond traditional e-commerce scenarios[55].

Market Validation

Market adoption evidence includes diverse customer profiles from DTC startups to Fortune 500 enterprises, suggesting platform scalability across organization sizes.

Competitive Wins

Competitive displacement occurs primarily in retail media scenarios where Amazon's first-party purchase data creates attribution advantages unavailable to competitors relying on intent signals or proxy metrics[44][52].

Reference Customers

Reference customer diversity spans industries from consumer electronics (EcoFlow) to automotive (Volkswagen) to consumer goods (Kazi), demonstrating broad applicability within retail-focused advertising objectives[48][55][56].

AI Technology

Amazon Advertising's technical foundation centers on its closed-loop ecosystem that integrates purchase data from Amazon.com, Twitch, and Fire TV with AWS machine learning models to predict conversion likelihood[44].

Architecture

Technical architecture emphasizes real-time processing capabilities, handling billions of daily impressions while maintaining sub-second bid response times[30][31].

Primary Competitors

Primary competitors include Google Ads for search advertising, Facebook/Meta for social advertising, and specialized retail media platforms like Criteo[52].

Competitive Advantages

Amazon Advertising's primary competitive advantage lies in its closed-loop ecosystem integrating purchase data from Amazon.com, Twitch, and Fire TV, enabling attribution capabilities unavailable to competitors like Google Ads, which relies primarily on search intent rather than actual purchase behavior[52].

Market Positioning

Market positioning context reveals Amazon's dominance in retail media consideration while trailing in broader digital advertising capabilities. The platform's strength in e-commerce attribution positions it as specialized rather than universal solution for advertising objectives[52][58].

Win/Loss Scenarios

Win scenarios consistently emerge when retail media represents primary advertising objectives, budgets exceed DSP minimums, and conversion goals align with Amazon properties[44][59]. Loss scenarios include B2B lead generation requirements, comprehensive cross-platform attribution needs, and situations where creative flexibility exceeds Amazon's current capabilities[46][52].

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of AI Ad Analytics for AI Marketing & Advertising for AI Marketing & Advertising professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

59+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.