DocuSign CLM (including Seal Software): Complete Buyer's Guide

Enterprise-grade contract lifecycle management solution

DocuSign CLM positions itself as a comprehensive Agreement Cloud platform that addresses critical pain points in legal contract management through AI-powered automation and workflow optimization. The platform's strategic foundation rests on combining DocuSign's established e-signature market leadership with Seal Software's AI-driven contract analytics capabilities, creating an integrated solution for automated clause extraction, risk analysis, and workflow automation[41][42][45].

Market Position & Maturity

Market Standing

DocuSign CLM occupies a strong enterprise market position built on DocuSign's established brand recognition in e-signature solutions and strategic AI capabilities acquired through the $188 million Seal Software acquisition[41][42][45].

Company Maturity

The vendor demonstrates substantial market maturity with documented enterprise customer implementations including Fortune 500 legal departments that leverage the platform's Salesforce integration advantages[58].

Industry Recognition

Industry recognition includes Forrester's documented ROI validation of 449% potential returns, though customer reviews reveal mixed implementation experiences with challenging UX and complex deployment requirements[48][50][53].

Strategic Partnerships

Company stability indicators include established enterprise relationships and integration partnerships with Salesforce and SAP Ariba, positioning DocuSign as a trusted vendor for large-scale implementations[58].

Longevity Assessment

The platform's long-term viability appears strong based on DocuSign's market position and enterprise customer base, though competitive pressure from AI-native solutions requires continued innovation investment[55][57].

Proof of Capabilities

Customer Evidence

Enterprise customer implementations demonstrate measurable outcomes across multiple industries and use cases. iCIMS reported that a significant majority of agreements no longer require legal intervention post-implementation, with substantial growth in custom agreement processing capabilities[51]. Vestwell achieved revenue acceleration through automated contracting, while Celonis accelerated digital transformation with centralized workflows that streamlined cross-departmental collaboration[58].

Quantified Outcomes

Quantified performance evidence shows substantial efficiency gains in properly executed implementations. Sprinklr reduced contract lifecycle duration by 84% post-integration, demonstrating the platform's potential for comprehensive workflow optimization[33]. AI-driven capabilities deliver 40% faster contract processing compared to manual methods, though implementation success varies significantly based on organizational readiness and resource allocation[2][16].

Market Validation

Market validation includes documented enterprise adoption among Fortune 500 legal departments that prioritize vendor stability and comprehensive integration capabilities[58].

Competitive Wins

Competitive wins demonstrate market traction against alternatives, though customer reviews reveal implementation challenges including complex UX and difficulty tracking opportunity-quote alignment[53].

Reference Customers

Reference customer evidence includes multiple enterprise implementations across industries, though approximately 30% of CLM projects stall at proof-of-concept due to template standardization failures that force legal teams to revert to manual processes for high-stakes contracts[44][53].

AI Technology

DocuSign CLM's technical foundation centers on Iris, its proprietary AI engine that enables agreement summarization and AI-assisted review capabilities, though current functionality supports only English-language contracts[43][46].

Architecture

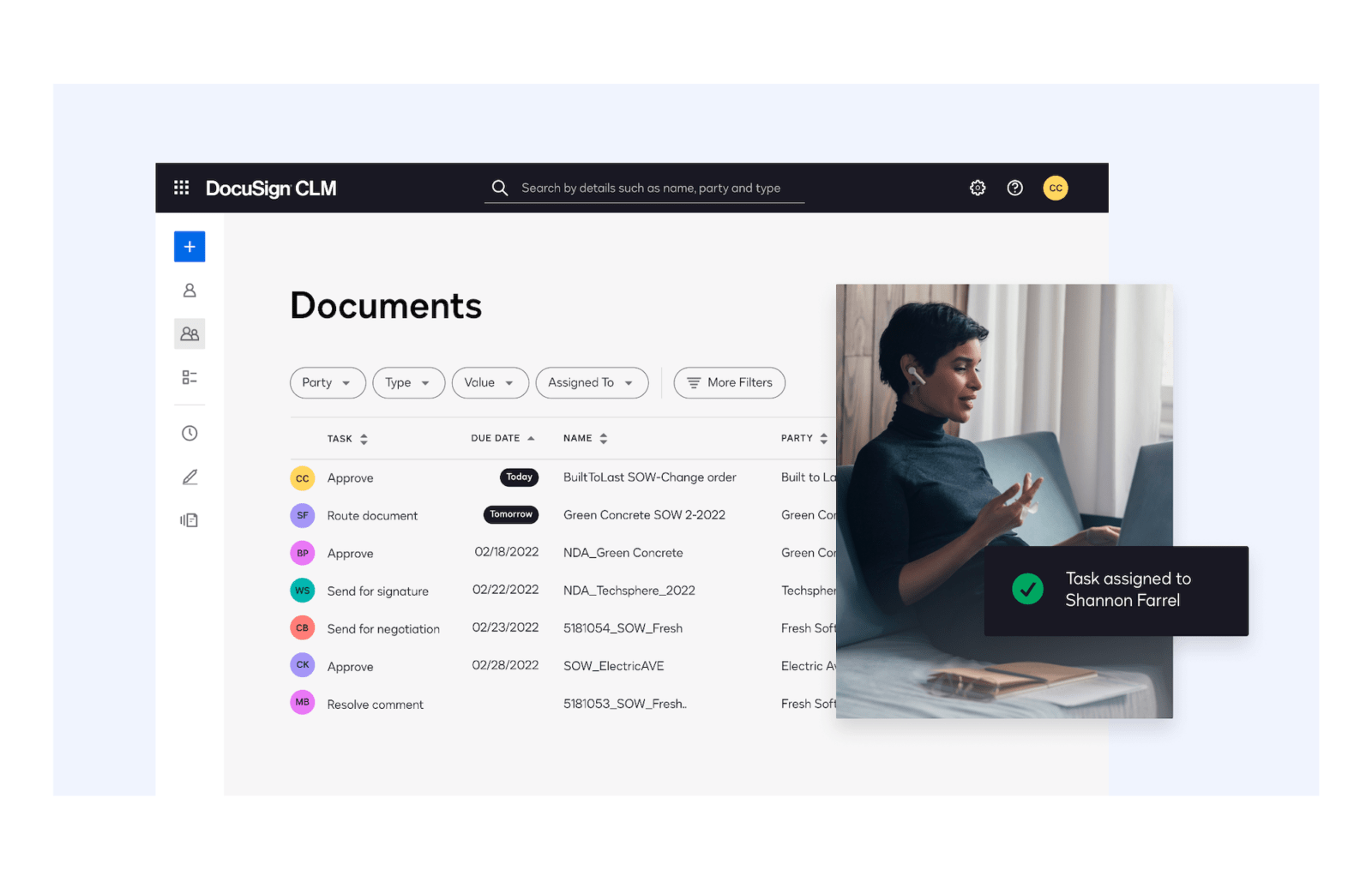

The workflow automation architecture features a drag-and-drop editor with pre-configured steps, though conditional logic implementation requires extensive customization and technical expertise[53][58].

Primary Competitors

Primary competitors include AI-native platforms like Evisort and Luminance that specialize in legal-specific AI training, offering domain expertise with 2 trillion legal token training for advanced functionality like handwritten text analysis[18][55][57].

Competitive Advantages

Competitive advantages center on Salesforce integration depth that provides significant benefits for enterprise organizations already invested in Salesforce ecosystems, combined with brand trust and market recognition in e-signature solutions that create adoption advantages[58].

Market Positioning

Market positioning emphasizes enterprise vendor stability and comprehensive integration capabilities, though AI-native platforms offer advanced legal-specific training that may provide superior accuracy for complex legal reasoning tasks[55][57].

Win/Loss Scenarios

Win scenarios favor organizations with established Salesforce environments and substantial contract volumes requiring comprehensive transformation[58]. Loss scenarios include organizations prioritizing rapid deployment, advanced AI capabilities, or cost-effectiveness for smaller contract volumes where alternatives provide better value propositions[35][55].

Key Features

Pros & Cons

Use Cases

Integrations

Featured In Articles

Comprehensive analysis of AI Lifecycle Management for Legal/Law Firm AI Tools for Legal/Law Firm AI Tools professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

59+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.