Featurespace ARIC: Complete Buyer's Guide

Enterprise-grade AI fraud detection platform

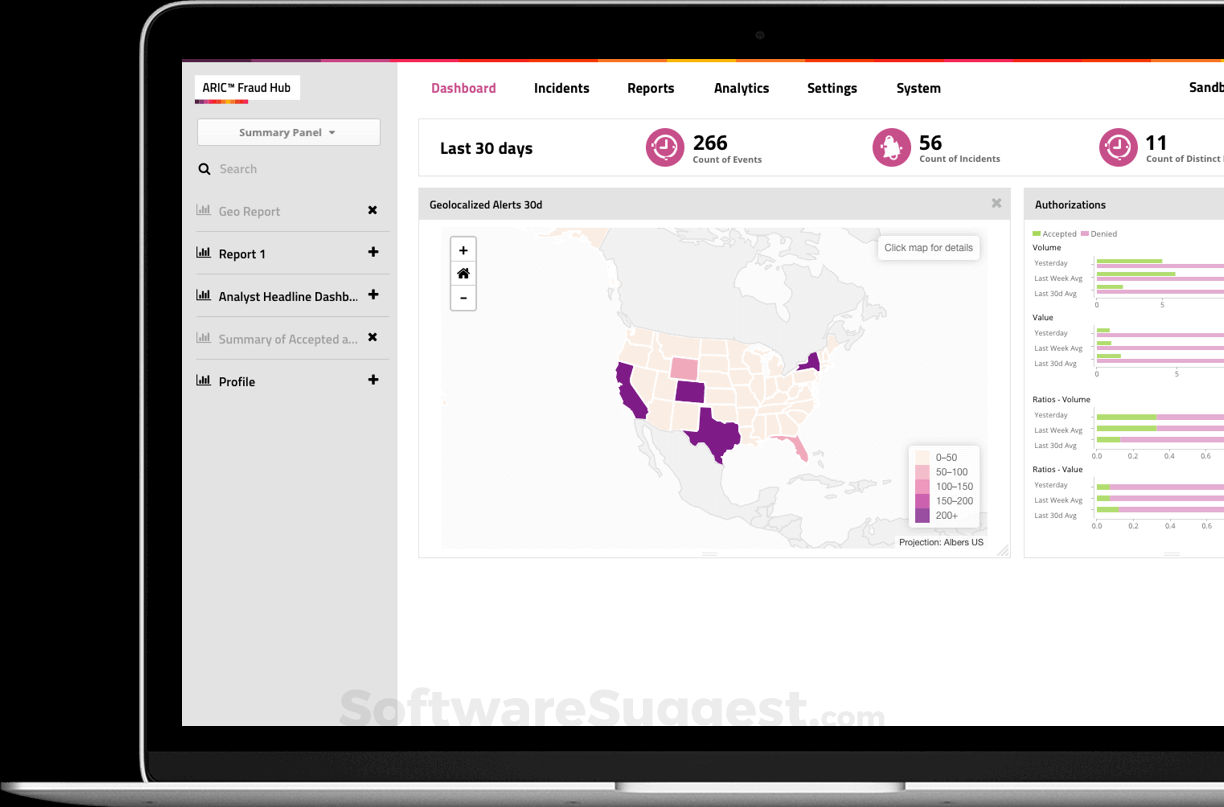

Featurespace ARIC positions itself as an enterprise-grade AI fraud detection platform built on Adaptive Behavioral Analytics and Automated Deep Behavioral Networks for real-time customer behavior profiling [39][43].

Market Position & Maturity

Market Standing

Featurespace demonstrates strong market maturity within financial services with documented enterprise implementations across major institutions including NatWest, Central 1 serving 295 Canadian financial institutions, and payment processor Enfuce protecting €2B in annual transactions [42][46][52].

Company Maturity

Operational scale evidence includes multi-tenant architecture supporting both cloud and on-premise deployments across diverse customer environments [39][41].

Industry Recognition

Industry recognition appears concentrated in financial services rather than broader ecommerce or retail fraud detection markets.

Strategic Partnerships

Strategic partnerships and ecosystem positioning focus on financial services integration, with documented success in payment processing environments.

Longevity Assessment

Longevity assessment suggests stable operations based on enterprise customer retention and continued platform development.

Proof of Capabilities

Customer Evidence

Enterprise customer validation demonstrates proven capabilities across financial services with documented implementations including NatWest for scam detection, Central 1 serving 295 Canadian financial institutions, and Enfuce protecting €2B in annual transactions across 16M users [42][46][52].

Quantified Outcomes

Quantified performance outcomes include measurable fraud detection improvements: eftpos achieved 86% value detection rate for card-not-present fraud while maintaining 5% false positive rates [50]. Central 1 reportedly achieved 75% reduction in online banking fraud losses and 15% alert volume reduction [46].

Case Study Analysis

Implementation success patterns show consistent deployment across complex financial environments. Central 1's integration required comprehensive workflow redesign to synchronize AI alerts with existing fraud team processes, while Enfuce prioritized cloud compatibility for rapid onboarding [42][46].

Market Validation

Market validation through customer retention appears strong based on continued enterprise relationships, though specific retention metrics remain unavailable in accessible documentation.

Competitive Wins

Competitive displacement evidence remains limited in available documentation, though the platform's behavioral analytics approach differentiates from traditional rule-based systems and network-effect competitors.

Reference Customers

Validated customer success in financial services includes implementations across NatWest, Central 1 serving 295 Canadian institutions, and Enfuce protecting €2B annually [42][46][52].

AI Technology

ARIC's core AI technology centers on Adaptive Behavioral Analytics and Automated Deep Behavioral Networks that create individual customer behavioral profiles in real-time [39][43].

Architecture

The platform's architecture supports sophisticated model flexibility through its Open Modeling Environment, enabling integration of third-party models including PMML, H2O, and TensorFlow alongside custom rules [39][47].

Primary Competitors

Primary competitors include Signifyd, Forter, and Kount [14][15][16][17].

Competitive Advantages

ARIC's competitive advantages center on behavioral analytics sophistication and model customization flexibility through the Open Modeling Environment supporting third-party models (PMML, H2O, TensorFlow) [39][47].

Market Positioning

Market positioning reveals ARIC as a specialized solution targeting sophisticated fraud detection requirements rather than mass-market deployment.

Win/Loss Scenarios

Win scenarios favor ARIC when organizations require sophisticated behavioral analytics, model customization flexibility, or hybrid financial services/ecommerce environments. Loss scenarios occur when buyers prioritize proven ecommerce-specific implementations, rapid SMB deployment, or extensive retail fraud pattern libraries.

Key Features

Pros & Cons

Use Cases

Featured In Articles

Comprehensive analysis of Fraud Detection for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

54+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.