MyCase + Intaker: Complete Buyer's Guide

Strategic integration for legal technology workflows

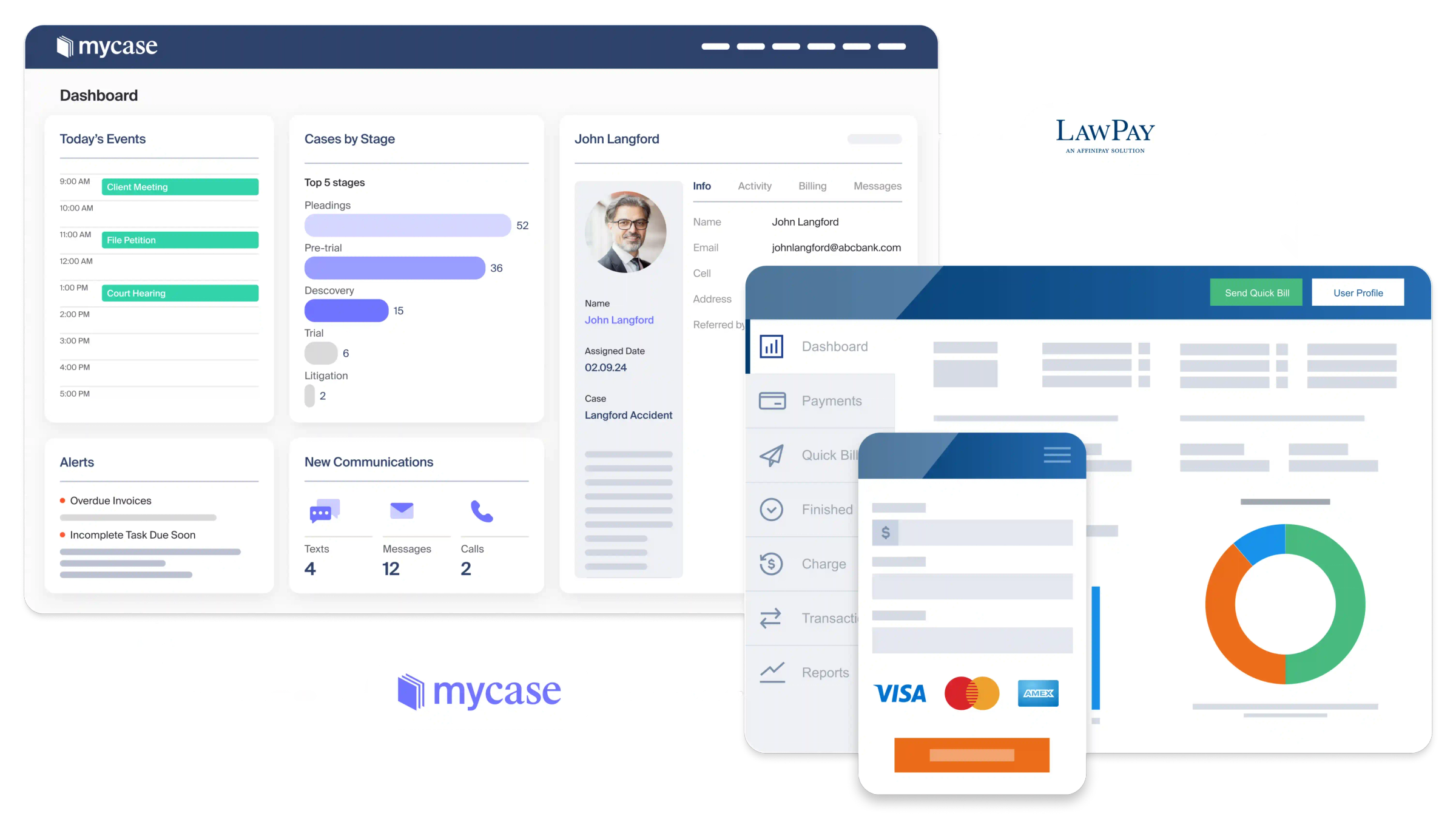

MyCase + Intaker represents a strategic integration between MyCase's established practice management platform and Intaker's AI-powered client intake capabilities, launched in 2022 to address critical gaps in legal technology workflows[41][43][44].

Market Position & Maturity

Market Standing

MyCase + Intaker occupies a specialized niche within the competitive legal AI landscape, targeting established MyCase users seeking enhanced client intake without platform migration[41].

Company Maturity

The partnership launched in 2022, indicating relatively recent market entry but building on MyCase's established practice management platform foundation[43].

Growth Trajectory

Positive customer adoption within the target market segment, with professional license defense firms successfully transitioning from Excel-based lead tracking to the integrated system[48].

Industry Recognition

Customer testimonials from established legal practices, with the Bay Area Family Law Center serving as an early adopter who tested the integration before public release[41][44].

Strategic Partnerships

Core MyCase-Intaker integration, with additional connections to document signing solutions including DocuSign and integration capabilities with Google Calendar, QuickBooks, and Microsoft Outlook through MyCase's platform[47][53].

Longevity Assessment

Evidence supporting long-term viability includes strong adoption patterns among larger legal practices and successful customer transitions from Excel-based systems[3][48].

Proof of Capabilities

Customer Evidence

Bay Area Family Law Center serves as the primary validation case, with Clint Higgins testing the integration before public release[41][44].

Quantified Outcomes

Measurable improvements in lead organization efficiency and conversion processes, with critical client information automatically uploaded to MyCase[41].

Case Study Analysis

Bay Area Family Law Center reported significant time savings in organizing and preparing leads[41].

Market Validation

Adoption strength among larger legal practices, with 39% adoption rates among firms with 51+ attorneys compared to 20% for smaller practices[3].

Competitive Wins

The platform's video-enhanced chat functionality has been successfully implemented to allow lawyers to showcase their personalities and communication styles during client interactions[41][50].

Reference Customers

Professional license defense firms provide additional customer evidence, with documented success transitioning from Excel-based lead tracking to MyCase's integrated system[48].

AI Technology

Leverages sophisticated AI-powered client engagement technology that combines conversational AI with video-enhanced interactions to create personalized legal client experiences[50][53].

Architecture

Cloud-based platforms with seamless one-way data synchronization from Intaker to MyCase[46].

Primary Competitors

Clio Grow and Law Ruler represent significant competitors, with Clio dominating the broader market through comprehensive practice management ecosystem integration[1][10].

Competitive Advantages

Seamless integration with established MyCase workflows and extensive multilingual support capabilities[53].

Market Positioning

Specialized niche within the broader legal AI landscape, targeting established MyCase users seeking enhanced client intake without platform migration.

Win/Loss Scenarios

Wins when firms prioritize existing technology investment protection, require extensive multilingual capabilities, or value video-enhanced client interactions for trust building.

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of AI Client Intake for Legal/Law Firm AI Tools for Legal/Law Firm AI Tools professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

57+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.