OpSec Brand Protection: Complete Buyer's Guide

Visual AI-powered trademark enforcement platform designed for enterprises managing complex global brand protection across 200+ jurisdictions.

OpSec Brand Protection is an enterprise-grade visual AI platform specializing in global trademark monitoring and enforcement for large-scale intellectual property portfolios.

Market Position & Maturity

Market Standing

OpSec operates in a competitive landscape where the top three vendors—MarkMonitor, OpSec, and Corsearch—control approximately 40% market share[15].

Company Maturity

OpSec serves a sophisticated customer base including luxury brands like Furla and regulated industries requiring comprehensive brand protection[47][50].

Growth Trajectory

The platform's enterprise focus and premium positioning suggest stable revenue from high-value customer relationships rather than rapid customer acquisition growth.

Industry Recognition

OpSec's focus on visual AI capabilities provides differentiation from keyword-focused competitors particularly for luxury goods and products where visual brand elements drive counterfeiting[49][52].

Strategic Partnerships

Strategic partnerships center on legal enforcement capabilities, differentiating OpSec from competitors that emphasize rapid automated responses.

Longevity Assessment

Longevity assessment appears positive based on established market position, enterprise customer base, and specialized technology capabilities.

Proof of Capabilities

Customer Evidence

The Furla case study provides the strongest validation, showing OpSec's ability to identify 429 infringing domains and achieve 98% enforcement compliance on marketplaces and 99% on websites and social media following platform deployment[50].

Quantified Outcomes

OpSec claims monitoring 40+ million annual infringements with 99% enforcement success rates on websites and social media[46][54].

Case Study Analysis

The Furla case study demonstrates OpSec's effectiveness in dismantling sophisticated counterfeiting networks that require both AI detection and legal expertise to resolve successfully.

Market Validation

OpSec's position among the top three brand protection vendors controlling 40% market share suggests sustained customer adoption and market acceptance[15].

Competitive Wins

Competitive advantages emerge in visual trademark detection, where OpSec's AI technology addresses limitations of keyword-based monitoring tools.

Reference Customers

Reference customers include luxury brands like Furla, sports organizations like UEFA, and pharmaceutical companies[47][50][54].

AI Technology

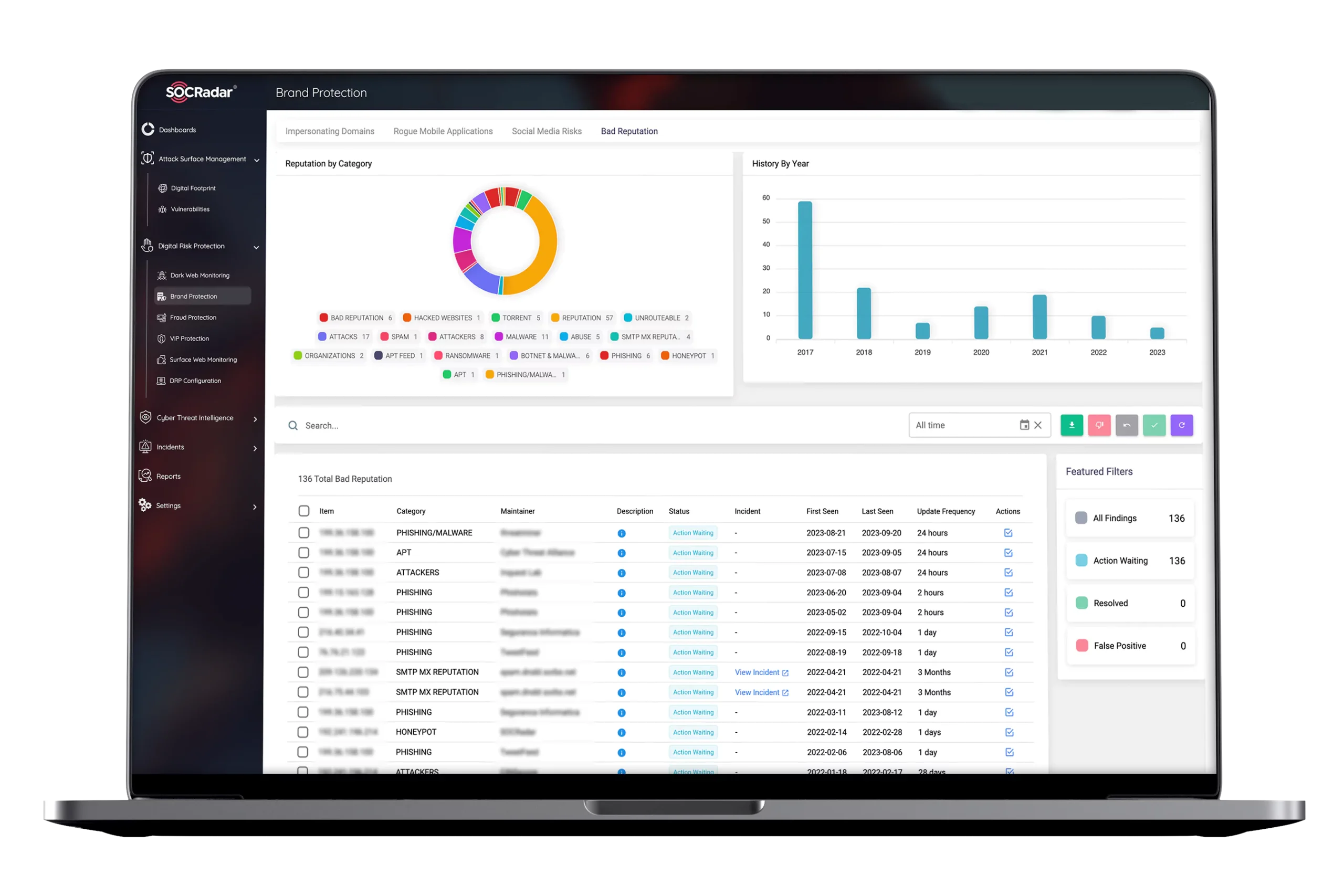

OpSec's Visual AI technology processes visual elements including logos, product designs, and brand imagery to identify potential violations that text-based tools frequently miss[46][54].

Architecture

Architecture and deployment follow a structured three-phase approach requiring 6-8 weeks for workflow integration[54].

Primary Competitors

Primary competitors include MarkMonitor for domain-focused protection, Corsearch for comprehensive IP monitoring, and emerging players like BrandShield offering advanced automated enforcement features[52].

Competitive Advantages

Competitive advantages center on Visual AI technology that detects trademark infringements through logo analysis, product imagery, and visual similarity matching across multiple platforms[46][54].

Market Positioning

Market positioning favors enterprises requiring comprehensive legal enforcement rather than organizations prioritizing rapid automated responses.

Win/Loss Scenarios

Win/loss scenarios favor OpSec when organizations need visual trademark detection, complex legal enforcement capabilities, and have sufficient resources for comprehensive implementation.

Key Features

Pros & Cons

Use Cases

Pricing

Featured In Articles

Comprehensive analysis of AI Trademark Monitoring for Legal/Law Firm AI Tools for Legal/Law Firm AI Tools professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

57+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.