Relativity: Complete Buyer's Guide

Dominant force in legal eDiscovery

Relativity stands as the dominant force in legal eDiscovery, evolving from a document-centric platform into a comprehensive AI-powered evidence management solution that now handles surveillance footage alongside traditional discovery materials. With legal AI adoption nearly tripling from 11% to 30% in 2024 and video evidence appearing in approximately 80% of criminal cases, Relativity's strategic pivot to integrated multimedia capabilities positions it uniquely for legal professionals managing complex evidence portfolios[64][65][67][68].

Market Position & Maturity

Market Standing

Relativity dominates the eDiscovery market with established enterprise relationships and comprehensive platform maturity that extends well beyond emerging AI capabilities.

Company Maturity

The company's market maturity is evidenced through 24/7 global support as part of its service offering, positioning comprehensive support as a competitive differentiator for enterprise customers[77].

Growth Trajectory

The vendor's strategic evolution reflects broader market dynamics, with server and private cloud solutions declining from 27% market share in 2024 to an expected 22% by 2029, creating migration pressure that Relativity leverages through its cloud-native RelativityOne platform[76].

Industry Recognition

Industry recognition centers on the platform's comprehensive approach to evidence management, though specific awards and analyst recognition require additional verification beyond vendor-reported achievements.

Strategic Partnerships

The vendor's strategic partnerships and enterprise relationships reflect established market presence, with customer adoption patterns indicating 'hundreds' of users embracing aiR solutions since general availability[73].

Longevity Assessment

Long-term viability appears strong based on the platform's established customer base and comprehensive service infrastructure, though the competitive landscape continues evolving as specialized AI tools demonstrate superior capabilities in specific use cases.

Proof of Capabilities

Customer Evidence

Documented customer implementations provide concrete evidence of Relativity's AI capabilities, with the Kroll case study serving as the primary validation of analytical processing strength. This implementation demonstrates RelativityOne's AI reducing 1.3 million documents to 250,000 through automated searches, ultimately identifying 40,000 key documents for priority review—representing measurable efficiency gains that translate to substantial labor cost savings[78].

Quantified Outcomes

Federal sector validation comes through Relativity's positioning as 'the only FedRAMP authorized generative AI solution purpose built for document review,' though this competitive exclusivity requires independent verification[73].

Case Study Analysis

The Kroll case study demonstrates RelativityOne's AI reducing 1.3 million documents to 250,000 through automated searches, ultimately identifying 40,000 key documents for priority review—representing measurable efficiency gains that translate to substantial labor cost savings[78].

Market Validation

Customer adoption metrics show 'hundreds' of users embracing aiR solutions since general availability, with reported time savings of 'months' per case[73].

Competitive Wins

Competitive context reveals Relativity's limitations relative to specialized tools: while BriefCam demonstrates 50% investigation time reduction through advanced video analytics and Veritone achieved 956 redactions in three hours for complex federal projects, Relativity's strength lies in workflow integration rather than specialized processing speed[53][61].

Reference Customers

Federal sector customers particularly value Relativity's compliance positioning, with the vendor emphasizing that aiR for Review represents 'the only FedRAMP authorized generative AI solution purpose built for document review,' though this competitive exclusivity claim requires independent verification as the competitive landscape includes other authorized solutions[73].

AI Technology

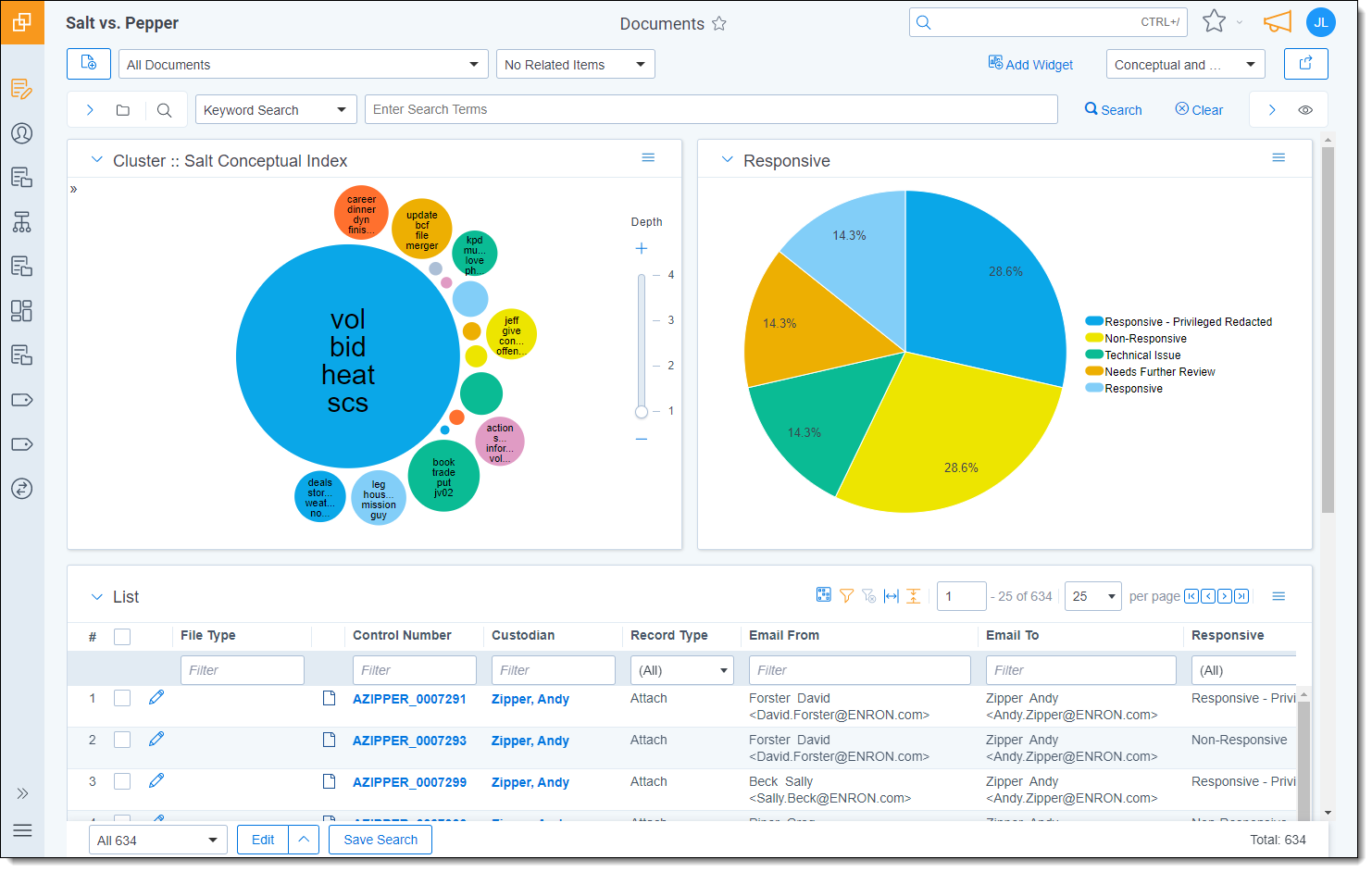

Relativity's AI architecture centers on its aiR product suite, which employs generative AI to predict relevant documents, locate material related to legal issues, and identify key documents early in case development[72][74].

Architecture

The platform's multimedia evidence capabilities extend beyond traditional document review through three primary technical components. A/V Transcription, launched in July 2025, converts audio and video files into searchable text within RelativityOne, supporting over 140 languages and enabling bulk processing of up to 10,000 files[80][82].

Primary Competitors

Primary competitors in surveillance evidence management include specialized platforms like BriefCam, which demonstrates 50% investigation time reduction through advanced VIDEO SYNOPSIS® technology and object tracking capabilities beyond Relativity's current multimedia offerings[53]. Veritone's automated redaction achieved 956 redactions in three hours, demonstrating processing efficiency that may exceed Relativity's pattern-based approach[61].

Competitive Advantages

Relativity's primary competitive advantage lies in platform consolidation for organizations handling both document and multimedia evidence, enabling unified case management across evidence types within familiar interfaces[80].

Market Positioning

Relativity's evolution from document-centric eDiscovery leader to comprehensive evidence management platform, though specialized competitors maintain processing advantages in video-specific workflows that may limit Relativity's expansion into surveillance-intensive applications.

Win/Loss Scenarios

Win scenarios favor Relativity for existing RelativityOne users seeking multimedia capabilities without workflow disruption, document-heavy cases with moderate surveillance evidence, enterprise environments prioritizing platform consolidation, and federal sector deployments requiring FedRAMP authorization.

Key Features

Pros & Cons

Use Cases

Featured In Articles

Comprehensive analysis of AI Surveillance Footage Review for Legal/Law Firm AI Tools for Legal/Law Firm AI Tools professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

83+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.