Sovos: Complete Buyer's Guide

Enterprise-grade tax compliance platform for multinational ecommerce operations

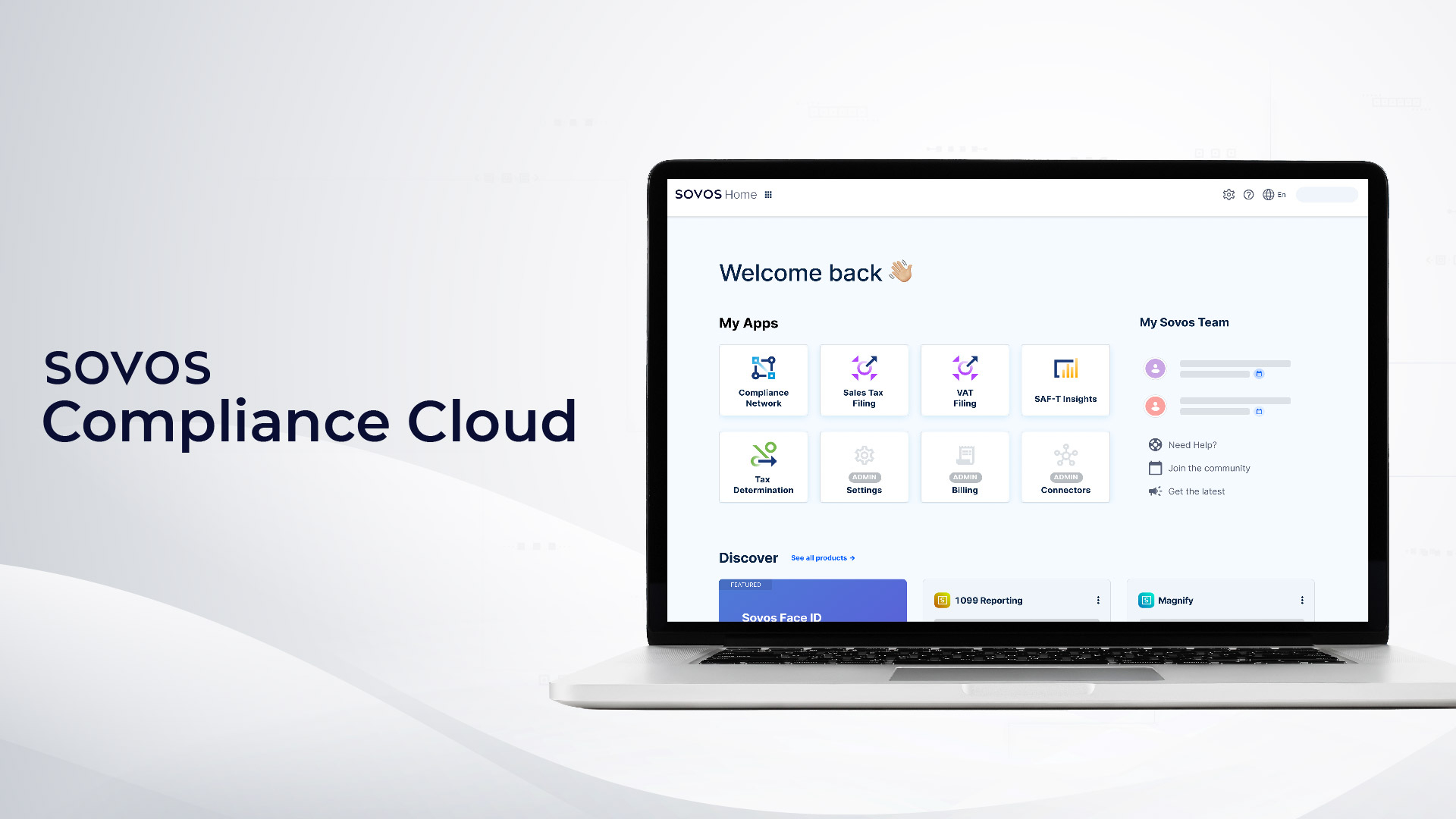

Sovos positions itself as the enterprise-grade tax compliance platform for multinational ecommerce operations requiring comprehensive regulatory coverage and proven scale capabilities. The company processes over 16 billion transactions annually across 200+ countries through its Compliance Cloud platform[40][43], establishing itself as a significant player in the global tax technology market.

Market Position & Maturity

Market Standing

Sovos occupies a distinct enterprise-focused position in the tax compliance vendor landscape, processing 16+ billion annual transactions versus Avalara's 1+ billion and TaxJar's estimated 100+ million[40].

Company Maturity

Company maturity indicators show strong operational scale with comprehensive international coverage across 200+ countries and 75+ pre-built ERP integrations[40][43].

Growth Trajectory

Expanding international coverage and increasing enterprise adoption, though specific revenue or funding metrics are not disclosed in available research.

Industry Recognition

Industry recognition centers on regulatory preparedness, with ViDA readiness for real-time e-invoicing mandates positioning Sovos ahead of alternatives in compliance evolution[51][77].

Strategic Partnerships

Strategic partnerships enhance market positioning, particularly the IFS-Sovos integration for comprehensive ERP connectivity[47][79] and Sovos-Tungsten partnership for AP automation integration[12].

Longevity Assessment

Longevity assessment supports continued operation based on enterprise customer base, comprehensive product development, and strategic partnership ecosystem.

Proof of Capabilities

Customer Evidence

Enterprise Customer Validation demonstrates Sovos' effectiveness across diverse industries and complex scenarios. Boscov's department store achieved 90% reduction in sales tax compliance effort post-Wayfair implementation[48]. A global chemical company implementation delivered 50% manual effort reduction and 35-50% ROI through VAT automation integrated with SAP S/4HANA migration[49]. Additionally, a global airline avoided $700,000 in penalties through real-time validation capabilities, projecting $2.3 million in 3-year savings[55].

Quantified Outcomes

Boscov's achieved 90% reduction in sales tax compliance effort[48]. A global chemical company demonstrated 50% manual effort reduction and 35-50% ROI[49]. A global airline avoided $700,000 in penalties with projected $2.3 million in 3-year savings[55].

Case Study Analysis

Successful implementations typically involve 5-member cross-functional teams over 12-week timeframes[77], with comprehensive testing phases significantly reducing go-live errors[63][76].

Market Validation

Customer retention appears strong based on documented success stories and ongoing implementations[48][49][55].

Competitive Wins

Sovos processes significantly more annual transactions than competitors like Avalara and TaxJar[40], while providing superior international coverage across 198 countries for real-time VAT determination[41][43][50][57].

Reference Customers

Documented customer implementations across global airlines, chemical companies, and major retailers demonstrate enterprise market penetration[48][49][55].

AI Technology

Sovos implements AI primarily through its GeoTAX geocoding technology and transaction pattern analysis within the Compliance Cloud platform.

Architecture

Technical architecture emphasizes comprehensive international coverage with real-time VAT determination across 198 countries and economic nexus tracking across 19,000+ jurisdictions[41][43][50][57].

Primary Competitors

Avalara, TaxJar

Competitive Advantages

Primary Competitive Advantages center on international coverage and transaction processing scale. Sovos processes 16+ billion annual transactions versus Avalara's 1+ billion and TaxJar's estimated 100+ million[40]. Coverage across 200+ countries exceeds most competitors' geographical reach[43].

Market Positioning

Strategic Positioning emphasizes regulatory-first architecture and enterprise-grade capabilities over broad market accessibility.

Win/Loss Scenarios

Win/Loss Scenarios favor Sovos for multinational operations requiring comprehensive regulatory coverage, particularly businesses facing ViDA mandates or complex B2B exemption scenarios[51][77].

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of Tax Compliance for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

85+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.