Thomson Reuters ESG Solutions: Complete Buyer's Guide

Enterprise-focused ESG compliance and sustainability reporting platform

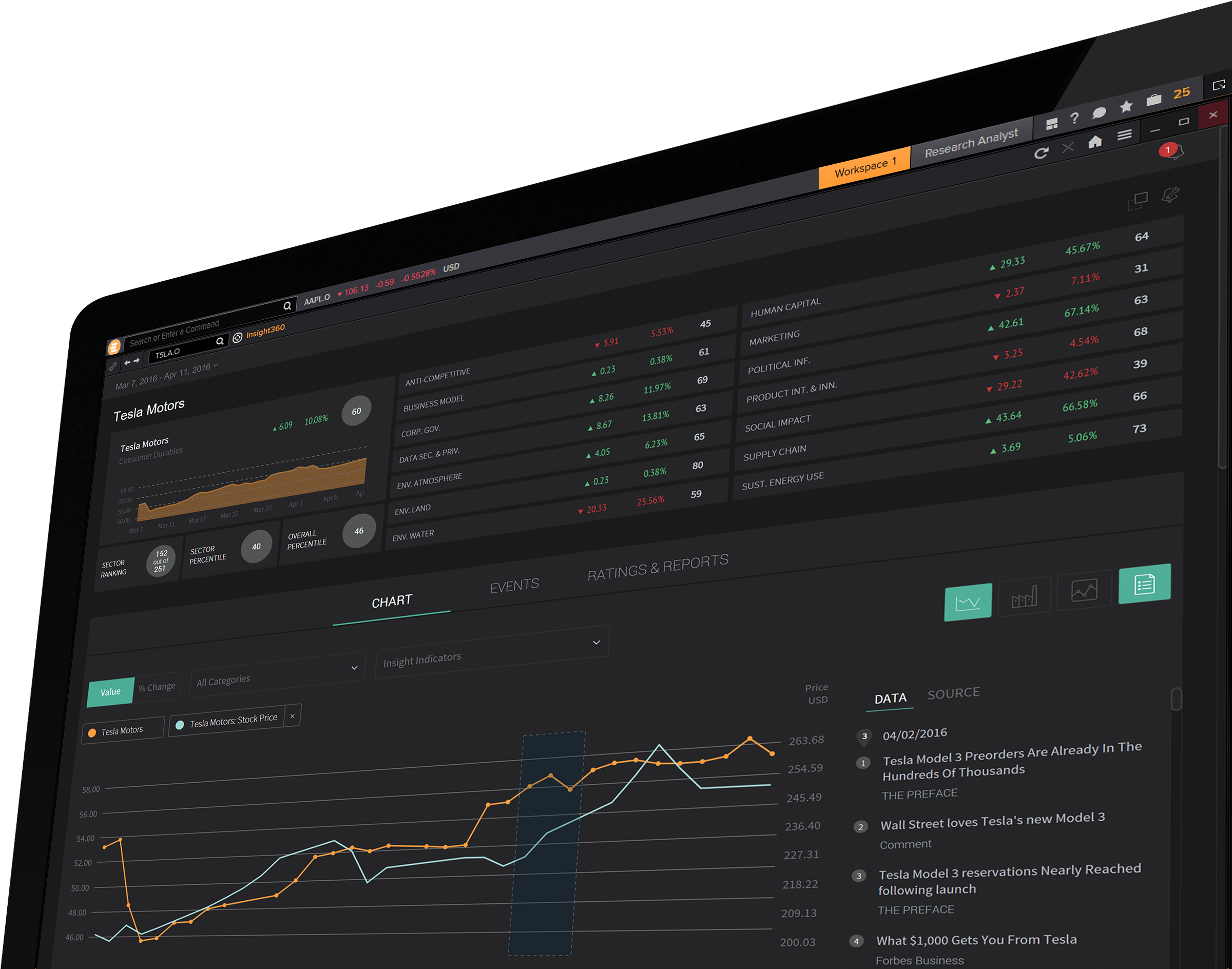

Thomson Reuters ESG Solutions is an enterprise-focused ESG compliance and sustainability reporting platform designed specifically for legal professionals and corporate legal departments navigating the complex intersection of environmental regulations and legal risk management.

Market Position & Maturity

Market Standing

Thomson Reuters operates as an established legal technology provider with significant market presence and financial stability, positioning the company advantageously in the rapidly evolving ESG compliance market.

Company Maturity

Thomson Reuters' legal industry expertise provides potential competitive advantages in a market where competitive dynamics increasingly favor firms leveraging AI for ESG due diligence [7].

Growth Trajectory

Operates within favorable market fundamentals, with 73% of lawyers expecting AI integration within 12 months [1][5] and 69% of law firms reporting insufficient ESG readiness [1][5].

Industry Recognition

Thomson Reuters' long-standing presence in legal technology markets, though specific ESG solution recognition requires verification through current analyst reports and customer feedback.

Strategic Partnerships

Likely leverage Thomson Reuters' existing legal industry relationships, though specific ESG-focused partnerships require verification.

Longevity Assessment

Benefits from Thomson Reuters' established business model and legal industry presence, providing confidence in continued operation and product development.

Proof of Capabilities

Customer Evidence

PNC Bank's implementation of AI-powered legal technology achieved 20% increase in compliance within the first month [25].

Quantified Outcomes

40% reduction in labor hours for sustainability reporting and identification of underreported plastic footprints in Asia-Pacific suppliers [34].

Case Study Analysis

KPMG's ESG technology implementation using AI platforms to ingest unstructured ESG data including PDFs and satellite imagery into standardized ontologies [34].

Market Validation

Small law firms demonstrating AI utilization growth from 27% to 53% between 2023–2025 [8].

Competitive Wins

Specific competitive advantages and customer outcomes require verification through direct evaluation rather than relying on unverifiable performance claims.

Reference Customers

Enterprise-scale validation comes from KPMG's ESG technology implementation [34].

AI Technology

AI-powered data standardization and regulatory tracking to address the core challenge where AI effectiveness is hinged on high-quality, clean data inputs [10][13].

Architecture

Core AI Architecture centers on automated compliance process optimization and predictive risk modeling capabilities.

Primary Competitors

Specialized ESG platforms like Persefoni and Watershed [16] and comprehensive GRC platforms like AuditBoard [16][18].

Competitive Advantages

Integration with Thomson Reuters' broader legal technology ecosystem, established vendor relationships with legal organizations, and legal-specific ESG compliance expertise [16].

Market Positioning

Among enterprise-focused solutions targeting large organizations with complex compliance needs [16].

Win/Loss Scenarios

Favor Thomson Reuters for organizations with existing Thomson Reuters technology investments seeking consolidated vendor relationships.

Key Features

Pros & Cons

Use Cases

Featured In Articles

Comprehensive analysis of AI ESG & Sustainability Compliance Audits for Legal/Law Firm AI Tools for Legal/Law Firm AI Tools professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

38+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.