Watershed Climate Impact Platform: Complete Buyer's Guide

Enterprise-grade carbon accounting platform delivering audit-ready emissions tracking and regulatory compliance automation for complex organizational requirements.

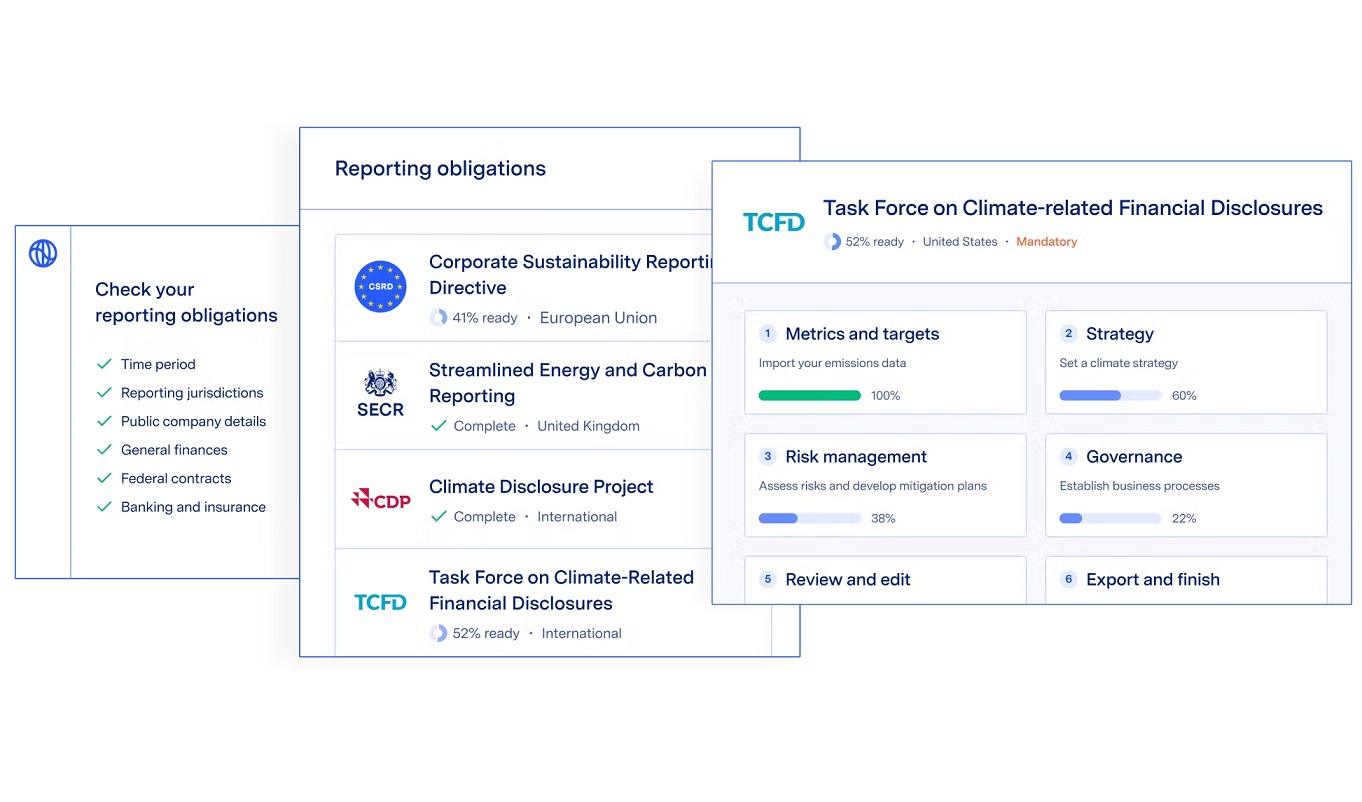

Watershed Climate Impact Platform operates as the leading enterprise solution for comprehensive carbon emissions measurement, management, and regulatory compliance, serving major organizations including BlackRock, Capital One, Walmart, Visa, and Airbnb [49][51]. The platform addresses critical data fragmentation challenges by consolidating emissions tracking across Scope 1, 2, and 3 categories while providing audit-ready reporting that meets evolving regulatory requirements [39][53].

Market Position & Maturity

Market Standing

Watershed maintains a dominant position in the enterprise carbon management market, serving major organizations including Airbnb, Carlyle Group, BlackRock, Capital One, Walmart, and Visa for climate and ESG data management [49][51].

Company Maturity

Company maturity indicators include comprehensive regulatory compliance capabilities and enterprise-grade security certifications. The platform maintains SOC 2 compliance, ISO-27001 and ISO-27701 certifications, demonstrating operational maturity and commitment to data protection standards required by enterprise customers [52].

Growth Trajectory

Growth trajectory evidence appears in the platform's expanding customer base and enhanced capabilities. The platform currently manages substantial carbon dioxide equivalent across its portfolio, with growth data showing significant scaling across enterprise implementations [51].

Industry Recognition

Industry recognition validates market leadership through multiple analyst acknowledgments. Forrester recognized Watershed as a leader in The Forrester Wave™: Sustainability Management Software, Q2 2024, while Verdantix designated Watershed as a leader in the 2023 Green Quadrant for Enterprise Carbon Management [49][50].

Strategic Partnerships

Strategic partnerships and ecosystem positioning enable comprehensive ESG compliance support through integration with complementary platforms and regulatory frameworks.

Longevity Assessment

Long-term viability assessment shows strong indicators through enterprise customer retention, continuous platform development, and regulatory alignment. The platform's focus on audit-ready capabilities and comprehensive regulatory support positions it well for evolving compliance requirements and sustained enterprise demand [47][42].

Proof of Capabilities

Customer Evidence

Enterprise customer validation demonstrates Watershed's effectiveness across major organizations including BlackRock, Capital One, Walmart, Visa, Etsy, and Paramount, showcasing scalability across diverse industries from financial services to retail and entertainment [51].

Quantified Outcomes

Quantified performance outcomes include significant efficiency improvements for enterprise customers. KPMG clients achieved 33% reduction in manual spreadsheet work and 28% faster advisory cycles through AI-powered ESG management implementations [34]. Organizations implementing similar AI ESG compliance tools report 40% reduction in compliance costs through automated data collection and standardized metrics [3].

Case Study Analysis

Implementation success evidence shows the platform's ability to handle complex enterprise deployments requiring cross-functional coordination. Watershed for CSRD enables companies to collect, calculate, and manage over 1,100 data points required under the Corporate Sustainability Reporting Directive through guided workflows and built-in project management tools [47].

Market Validation

Market validation metrics include the platform's management of substantial carbon dioxide equivalent across its customer portfolio, with growth data showing significant scaling across enterprise implementations [51].

Competitive Wins

Technical capability proof emerges through analyst recognition and competitive assessments. Verdantix specifically noted that Watershed "was a top scorer for data aggregation – Scope 3 capabilities, particularly excelling with its financed emissions management offering" [50].

Reference Customers

Enterprise customers, notable implementations, and industry validation.

AI Technology

Watershed's AI-driven carbon accounting architecture represents sophisticated enterprise-grade technology designed for comprehensive emissions management and regulatory compliance. The platform leverages machine learning algorithms that automate data categorization, identify calculation errors, and detect anomalies in carbon footprint calculations, ensuring accuracy and reliability across complex organizational data [53].

Architecture

The core technology foundation centers on Watershed's proprietary Comprehensive Environmental Data Archive (CEDA), containing over 60,000 emissions factors from 148 countries and 400 activities, updated twice annually to maintain regulatory compliance and accuracy [53].

Primary Competitors

Primary competitive landscape positions Watershed alongside Persefoni and Avarni in the enterprise carbon management space, with particular differentiation in supply chain emissions management and financed emissions capabilities [44][50].

Competitive Advantages

Competitive advantages include advanced scope 3 forecasting capabilities and ROI calculator functionality that enable organizations to model emissions reduction scenarios and quantify financial impact [50]. Watershed's benchmarking functionality and abatement best practices library provide competitive advantages over point solutions [49][50].

Market Positioning

Market positioning strategy places Watershed as the enterprise leader in carbon management competing on comprehensive functionality rather than price or simplicity. Premium positioning comes with corresponding complexity and cost that aligns with enterprise requirements but may limit broader market adoption [49][50].

Win/Loss Scenarios

Win/loss scenarios favor Watershed for organizations requiring comprehensive scope 1-3 emissions tracking with audit-ready reporting capabilities [39][53]. Companies needing sophisticated supply chain emissions management and regulatory compliance automation represent ideal target customers [50][47].

Key Features

Pros & Cons

Use Cases

Integrations

Featured In Articles

Comprehensive analysis of AI ESG & Sustainability Compliance Audits for Legal/Law Firm AI Tools for Legal/Law Firm AI Tools professionals. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

55+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.