Zendesk Sell: Complete Buyer's Guide

Mid-market CRM solution for SMBs and mid-market retailers

Zendesk Sell positions itself as a mid-market CRM solution targeting SMBs and mid-market retailers seeking straightforward sales management with mobile accessibility[50][53].

Market Position & Maturity

Market Standing

Zendesk Sell operates within the established Zendesk ecosystem, benefiting from the parent company's market presence in customer service software while competing in the crowded CRM market against Salesforce, HubSpot, and Freshsales[52].

Company Maturity

Company maturity benefits from Zendesk's established market presence and operational scale, providing buyer confidence in long-term viability and continued operation.

Growth Trajectory

Growth trajectory appears focused on mid-market expansion through partnership-driven AI capabilities rather than internal development.

Industry Recognition

Industry recognition remains limited compared to market leaders, with competitive positioning challenged by alternatives offering more comprehensive native capabilities.

Strategic Partnerships

Strategic partnerships with AI providers demonstrate commitment to capability expansion, though this approach introduces vendor management complexity and additional costs[40][43][44].

Longevity Assessment

Zendesk's established market presence and operational scale provide buyer confidence in long-term viability and continued operation.

Proof of Capabilities

Customer Evidence

Customer evidence includes the Lush Cosmetics implementation, which achieved 369% ROI with under one-year payback through improved customer experience management[48].

Quantified Outcomes

Quantified outcomes remain limited beyond vendor-reported case studies. While Lush Cosmetics achieved significant ROI, independent verification of these claims is unavailable[48].

Case Study Analysis

Case study analysis reveals implementation success patterns among SMBs requiring basic sales management functionality. The Freshly deployment succeeded through realistic scope management and internal resource allocation[53].

Market Validation

Market validation shows primary adoption among SMBs and mid-market retailers, with limited documented pure ecommerce business implementations.

Competitive Wins

Competitive wins appear limited against established alternatives. The platform's integration flexibility may appeal to organizations preferring choice in AI capabilities[52].

Reference Customers

Reference customers include Lush Cosmetics and Freshly, demonstrating success in retail environments[48][53].

AI Technology

Zendesk Sell's technology strategy centers on integration-dependent AI capabilities rather than embedded intelligence[40][41][43][45].

Architecture

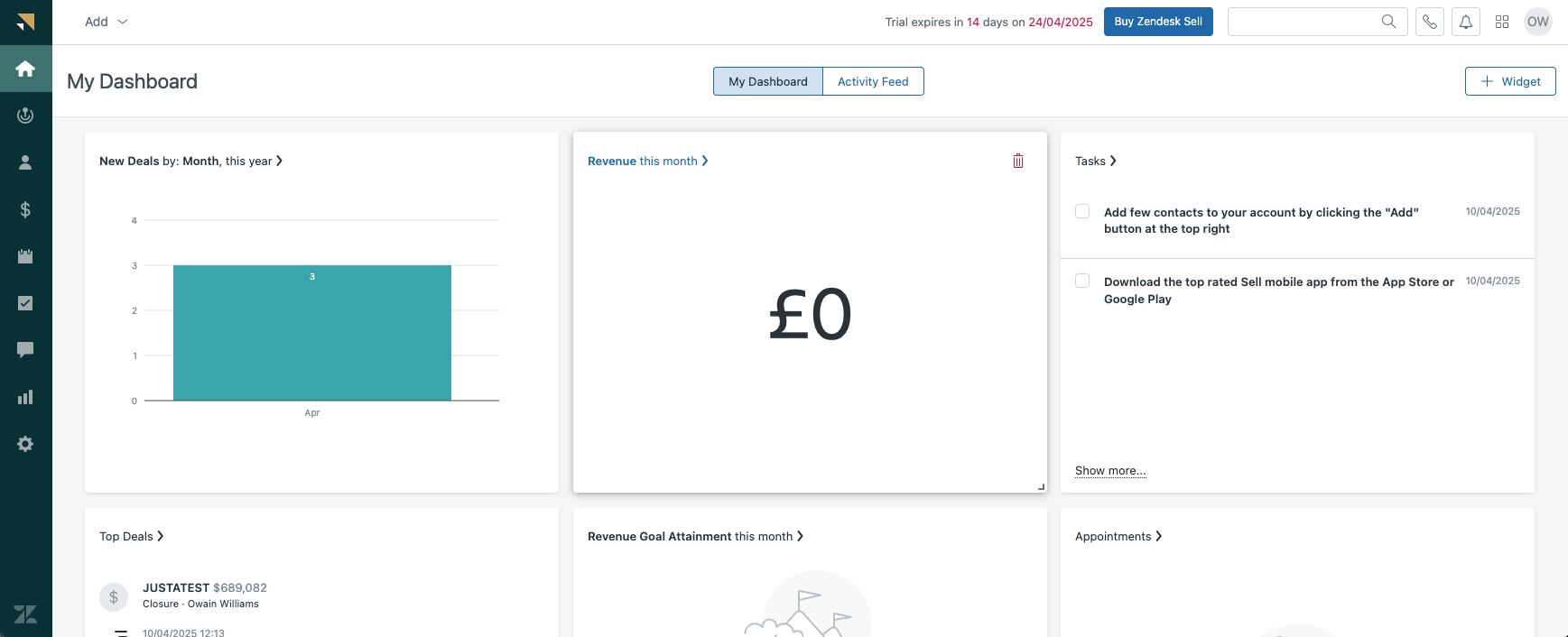

Architecture & Deployment follows a cloud-native approach with mobile-first design principles supporting omnichannel retail operations[53].

Primary Competitors

Primary competitors include Salesforce, HubSpot, and Freshsales[52].

Competitive Advantages

Competitive advantages center on integration flexibility and mobile accessibility[40][43].

Market Positioning

Market positioning places Zendesk Sell in a challenging middle ground—positioned as a mid-market solution but pricing approaches enterprise levels without delivering equivalent native capabilities[50][52].

Win/Loss Scenarios

Win/loss scenarios favor Zendesk Sell primarily for organizations prioritizing integration flexibility over embedded intelligence[40][52].

Key Features

Pros & Cons

Use Cases

Integrations

Pricing

Featured In Articles

Comprehensive analysis of CRM for Ecommerce for Ecommerce businesses and online retailers. Expert evaluation of features, pricing, and implementation.

How We Researched This Guide

About This Guide: This comprehensive analysis is based on extensive competitive intelligence and real-world implementation data from leading AI vendors. StayModern updates this guide quarterly to reflect market developments and vendor performance changes.

57+ verified sources per analysis including official documentation, customer reviews, analyst reports, and industry publications.

- • Vendor documentation & whitepapers

- • Customer testimonials & case studies

- • Third-party analyst assessments

- • Industry benchmarking reports

Standardized assessment framework across 8 key dimensions for objective comparison.

- • Technology capabilities & architecture

- • Market position & customer evidence

- • Implementation experience & support

- • Pricing value & competitive position

Research is refreshed every 90 days to capture market changes and new vendor capabilities.

- • New product releases & features

- • Market positioning changes

- • Customer feedback integration

- • Competitive landscape shifts

Every claim is source-linked with direct citations to original materials for verification.

- • Clickable citation links

- • Original source attribution

- • Date stamps for currency

- • Quality score validation

Analysis follows systematic research protocols with consistent evaluation frameworks.

- • Standardized assessment criteria

- • Multi-source verification process

- • Consistent evaluation methodology

- • Quality assurance protocols

Buyer-focused analysis with transparent methodology and factual accuracy commitment.

- • Objective comparative analysis

- • Transparent research methodology

- • Factual accuracy commitment

- • Continuous quality improvement

Quality Commitment: If you find any inaccuracies in our analysis on this page, please contact us at research@staymodern.ai. We're committed to maintaining the highest standards of research integrity and will investigate and correct any issues promptly.